By focusing on specialists and ruthlessly saying no to anything outside Coforge's focus areas has helped Sudhir Singh raise his team's aspirations to play in the big leagues

[CAPTION]Sudhir Singh, CEO, Coforge

Image: Madhu Kapparath[/CAPTION]

[CAPTION]Sudhir Singh, CEO, Coforge

Image: Madhu Kapparath[/CAPTION]

If you had an interest in the underpinnings of Lloyd’s of London, one of the things you’d discover would be that between a quarter and a third of the volumes on this globally known insurance and reinsurance market runs on AdvantageGo, a tech platform built by a relatively small IT company with most of its people in Noida.

One of the IT company’s original founders once described it as “the most profitable distraction” they had, as reported by The Hindu Business Line in May 2022. Their first love was education, and they’ve gone back to it, but that’s a story for another day.

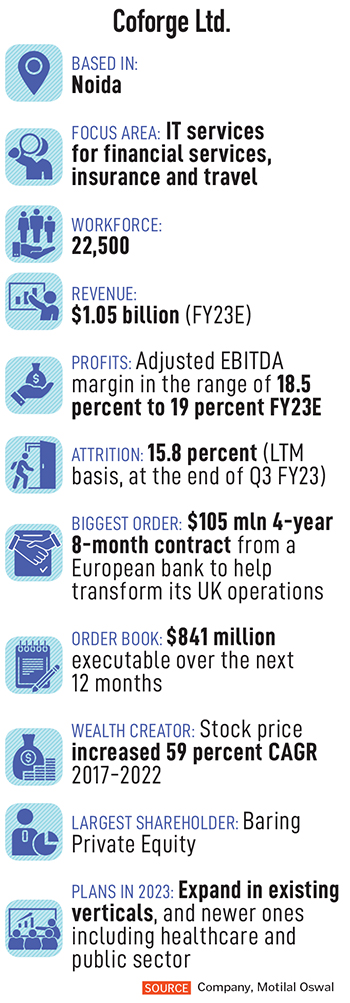

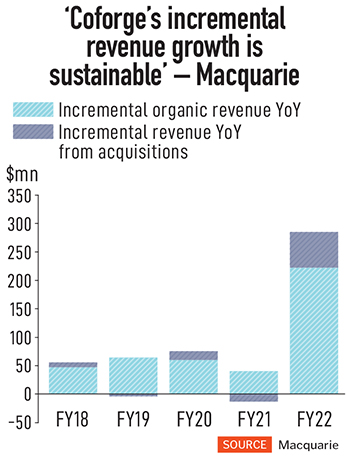

_RSS_The founders sold the tech services part of the 30-year-old company, then called NIIT Technologies, to Baring Private Equity in 2019. A professional CEO, who’d come in about a year earlier, forged Coforge out of it—the name change happened around August 2020—and took it from about $440 million for the year ended March 31, 2018, to about a $1 billion for the current fiscal year, based on the company’s latest estimates.

This is the story of how that CEO, Sudhir Singh, achieved that milestone, and what he and his 22,500-strong team want to do next.

Singh loves to talk about how Coforge is “atypical” for a company its size. This comes from the playbook that he and his chosen 14 deputies have put together. “We are engineers and technologists who spend an inordinate amount of time understanding the very limited functional spaces that we focus on,” he says.

In practice, that translates to not just bringing the tech chops to any conversation with clients, but a deep understanding of their world. In their jargon, they know everything there is to know about L1 to L5 processes of the industries they work in—meaning everything from an initial discussion to the eventual functional specifications that the tech needs to deliver.

In practice, that translates to not just bringing the tech chops to any conversation with clients, but a deep understanding of their world. In their jargon, they know everything there is to know about L1 to L5 processes of the industries they work in—meaning everything from an initial discussion to the eventual functional specifications that the tech needs to deliver.

With the insurance platform, for example, “there was no one who came in and said ‘these are the functional specs, these are the tech specs, now you build a platform for us’. It’s a space that we know completely—soup to nuts,” Singh says.

For example, if a well-known political figure, or say an influential business tycoon was looking for insurance against ransomware, there’s no scaled-up monolithic solution for that. But Coforge’s insurance tech specialists know how to build the applications to offer such a product for their insurance clients, Singh says.

Another aspect of the playbook was to focus on only three verticals—financial services, insurance and travel. And even within those, they started out by laying out for themselves which specific subsets or segments they would attack: Personal and casualty (P&C) insurance, for instance, for only airlines and airports in travel.

This helped Singh and his top executives bring on board specific subject matter experts, tech architects and so on. Today, the company boasts 3,000 consultants who can hold their own in their areas of expertise, and help clients in those verticals find the best solutions. These consultants don’t offer gyan like management consultancies do, Singh says. Rather, they offer their lived experience in the real world.

Also read: How Sudhir Singh made Coforge a $1-billion company

Larger orders

This all helped the company win larger orders along the way, including, in the most recent quarter, two $30 million orders and one $50 million order, announced for the three-month period ended December 31, 2022. The company’s largest order was announced in July 2021, when it reported a $105 million contract from a European bank to transform its UK operations.

This fiscal, in January, Coforge raised its forecast for full-year revenue growth to 22 percent from an estimate of at least 20 percent made in July 2022. That means the company expects to end FY23 with revenues in excess of $1 billion, from $866.5 million in FY22.

And Singh aspires to double the company’s revenue again, to hit $2 billion, over the next few years, although he hasn’t publicly committed to a timeline for that. Still, senior industry analysts have taken note of what he’s already done.

“

Sudhir has done an amazing job building a team to get to $1 billion, and which can get to $2 billion,” says Ray Wang, founder and principal analyst at Constellation Research, in the US. “The secret behind his success is knowing what strategy to apply at what phase of the company.”

Biggest opportunities

Today, after ruthlessly focusing on their narrow areas of expertise, and ignoring anything outside that playbook, Coforge is ready to expand. One of the biggest opportunities is to build on the expertise they already have in their chosen verticals.

Therefore, in insurance, for example, they are ready to go after the entire sector, and not just the P&C segment. Or in travel, they’re moving into hospitality, trains, logistics, and travel tech.

Second, they now have the wherewithal to get into completely new verticals. They’ve identified healthcare and public sector as their next big bets, with the latter more in their global markets and not in India.

On the tech side, Singh points out that they, too, are building more capabilities in the same areas as competitors and larger rivals. Meaning areas such as cloud computing, digital services, low-code and no-code applications, AI and so on. They aim to differentiate themselves in the way they offer solutions around these areas.

Data engineering is another big area of investment at Coforge. Further, Singh also wants to make a dent in offering solutions around Salesforce and Microsoft technologies—areas where Coforge isn’t really present yet.

Also read: From Mphasis to WNS, four midcaps changing the Indian IT game The backdrop

The timing for all this might work out too, because many changes are happening at once in the Indian IT services companies’ biggest markets.

For example, customers are already asking Coforge to look into how ChatGPT might be used, so “the speed of adoption seems to have increased”, for emerging tech, Singh says.

Coforge has an AI-based solution called Quazar, an intelligent document processing software, and the company is already injecting ChatGPT into it for specific uses within the insurance space.

Similarly, with metaverse—the online 3D animation-based virtual environments being promoted by Facebook parent Meta and others—some customers, such as financial clients, felt it needed to mature, before it was of any use. Others, like in the travel industry, however, found immediate uses, Singh says.

Travel operators are finding use cases around metaverse extremely useful in their attempt to get away from brochures, which were all about photographs, and actually generating use cases where they can take their clients. For instance, use the technology to give them a sense of where they are likely to land up if they sign up for a tour package.

After the Covid pandemic, businesses are far more willing to try out tech to improve their operations, reach more customers and so on. And a related aspect is that a bigger share of the tech budget is seen as investments that are needed and not discretionary, whereas even five years ago, IT providers kept track of the non-discretionary aspects of the CIO’s (chief information officer) budget because it fluctuated with the fortunes of the business, Singh says.

Companies are also stepping up their tech spends on the so-called “middle office” processes, which, in turn, is boosting low-code and no-code software applications. In Coforge’s own case, low-code and no-code software services account for about 15 percent of the company’s total revenue, according to Singh, a big share for a company of its size.

And as businesses look towards technology more, for IT vendors like Coforge, conversations are going well beyond the CIO’s department. COOs and other business executives are getting more involved. With one customer, the CIO has taken over as the CEO of the company, Singh says.

Also read: Flood of layoffs, dropping job volumes and changing work trends: Troubles in lives of Indian IT workers In the trenches

In 2018, when Singh’s appointment was announced, with co-founder Arvind Thakur saying he would transition the role to Singh and step down as CEO, the markets didn’t exactly welcome the news. The stock fell nearly 11 percent in Mumbai. Looking back, however, a ₹100 investment in the stock in April 2017 would be worth ₹1,200 today.

Singh is an army brat and bounced around from cantonment to cantonment, he recalls. One of his favourite anecdotes is also one he heard from his father about an officer who’s taken to task by a soldier for being absent from the trenches when the bullets were flying. He uses the anecdote to talk about the kind of leadership he always wants to foster at Coforge, he says, the kind where the leaders are in the trenches with their subordinates.

With an engineering degree from IIT BHU, and an MBA from IIM Calcutta, he started his career with HUL in the mid-90s. “I did the entire management-trainee stint, the sales stint, I was there as a brand manager, a senior brand manager,” he recalls. He left after six-and-a-half years to join Infosys, because he recognised IT services as “the ultimate (global) horizontal”, and never looked back. “I thought if I could sell atta and personal products in India, I could sell anything.”

He moved to the US at Infosys, stayed for almost a decade and then came back so his children could grow up in India, taking up a senior role at BPM giant Genpact. Leading Coforge gave him a chance to go back to the US and he runs the company from his Princeton, New Jersey base.

At Coforge, he overhauled his top leadership to include executives who were comfortable with large-scale operations, an important factor that has contributed to its growth.

To demonstrate what he wanted in terms of the “performance ethic” of the company, he quadrupled incentives for those who would land large deals. And for the delivery side of things, the range of increments was tripled “straight off the bat”, he says. The company also invested in its facilities, and overall, created an environment for people to thrive, he says.

Then there was the playbook: “We walked away from a lot of businesses and we said we will focus on a few spaces where we have enough expertise so that we can stand up against anyone instead of operating right across and losing against scale players most of the time.”

Fourth, he also overhauled what he calls the backend, meaning the entire large portion of the organisation that actually delivered on the orders won. This was crucial because “longer term, clients will stay with you, repeat business will be very high if their lived experience of the actual delivery is good,” he says.

Coforge’s delivery organisation, six years ago, had just three pillars—infrastructure, BPO and ADM (application development and maintenance). “Today we have 16 service lines under exceptional leaders and with very strong subject matter experts, which has differentiated us.”

That all sets Coforge to go after its next phase of growth, analysts like Constellation’s Wang note: “Coforge is at a stage where they can start to make concentrated bets that will allow them to win larger deals and take more budget at every account,” Wang says.

“This will require a different approach of selling into large accounts that requires a portfolio approach but they have put together a team that can help clients find the right solutions and the right team,” he adds.

Singh says: “We would like to be a consulting organisation, because I don’t think that anyone can provide consulting in the true sense of the word better than a tech services organisation that understands process.”

“We are the people who are in the weeds. Our employees know on a day-to-day basis what is happening across platforms, across lines of businesses, across client organisations, and then across multiple client organisations,” he says. Therefore, if Coforge can execute its new playbook of focussed expansion, if a large customer wants a solution for something, “we should be one of the three players that they would pick up the phone and speak to.”